European Commission

As the brutality of the Russian invasion increased, the European Union approved the fifth package of sanctions against the Kremlin’s war machine.

These measures are broader and harsher and dig even deeper into the Russian economy. They follow atrocities committed by Russian forces in Bucha and elsewhere in Ukraine under Russian occupation.

They target six main issues:

🛑 import of coal from Russia

🛑 transactions with 4 Russian banks

🛑 access of Russian vessels to EU ports

🛑 further imports and exports to Russia

🛑 exclusion of Russia from public contracts and European funds

🛑 individual listing of people

Together with the four previous packages, these sanctions will help to further increase economic pressure on the Kremlin and affect its ability to finance the invasion of Ukraine.

Read more → europa.eu/!jHJn8X

#EUSolidarity #Ukraine #StandUpForUkraine

https://media.licdn.com/embeds/native-document.html

Read more → europa.eu/!jHJn8X

Russia wants “unfriendly countries” to pay for Russian natural gas in rubles. That’s a new directive from President Vladimir Putin as he attempts to leverage his country’s in-demand resources to counter a barrage of Western sanctions.

“I have decided to implement … a series of measures to switch payments — we’ll start with that — for our natural gas supplies to so-called unfriendly countries into Russian rubles,” Putin said in a televised government meeting, adding that trust in the dollar and euro had been “compromised” by the West’s seizure of Russian assets.

The new requirement appeared aimed at propping up the flagging Russian currency, the ruble, by increasing demand for it. Its value gained against the dollar and the euro following Putin’s announcement. Natural gas prices surged in Europe, where Russia has supplied about 45% of imports.

Marcel Salikhov, president of the Institute for Energy and Finance in Moscow, said the move amounted to a “symbolic counter-sanction” aimed at the West. He noted that the Kremlin had already ordered exporters to exchange 80% of their foreign-currency proceeds for rubles.

Souce: NPR.org

🌎 Europe

All of these countries (the United States, France, Germany, Britain, Canada, Italy and the European Commission) “have stressed their readiness to take further action if Russia does not halt to its attack on Ukraine and therefore on peace in Europe,” the spokesperson stressed.

🌎 SWIFT West Response to Russia

The Western partners have decided to further restrict the access of the Russian central bank to the capital markets, in order to make more difficult its attempts to support the price of the ruble, which is in decline following the war in Ukraine.

According to the European Union, about 70% of the Russian banking sector is currently affected by the sanctions. European Commission President Ursula von der Leyen has spoken of “crippling” the assets of the Russian central bank.

Are concerned “all Russian banks already sanctioned by the international community, as well as if necessary other institutes”, specified the spokesman of the German government, whose country currently chairs the G7 forum.

These measures have been taken by the United States, France, Germany, Great Britain, Canada, Italy and the European Commission. “Canada supports the withdrawal of Russian banks from SWIFT, and the targeting and restriction of Putin’s war chest,” Deputy Prime Minister and Minister of Finance of Canada Chrystia Freeland said on Twitter.

Sanctions aimed at excluding Russian banks from the global system and hampering the country’s central bank make Russia a financial “pariah” facing a “freefalling” ruble, a senior US official said on Saturday.

“Russia has become a global economic and financial pariah,” he said, and the Russian central bank “cannot support the rouble.” “Only Putin can decide what additional cost he is willing to bear,” the official said, adding that a task force will “hunter” the “yachts, jets, luxury cars and luxury homes” of Russian oligarchs.

(Berlin) Western countries have adopted new sanctions against Moscow after the invasion of Ukraine, in particular by deciding to exclude many Russian banks from the Swift interbank platform, an essential cog in global finance, the German government has announced. .

Christine Lagarde Presidente European Central Bank

Russia is not alone and there is China, India, South Africa and Brazil, the BRICS are building a wall of protection against any financial impediments against Russia.

Too bad, Ms. Christine Lagarde, the inflation will find a warm welcoming nest in these sanctions where to procreate and expand not only in Europe but to the trade partners of the European Countries. Energy prices are rising, threatening household budgets and corporate profits (except for the energy sector). In addition, the expected disruption of sanctions against Russia and Belarus will impact trade flows, which could further dampen the global economy, and Europe will be the first to suffer.

Russia was dependent on SWIFT, some 300 Russian banks and other financial institutions use the SWIFT system, and Russia is ranked second (behind the United States) in number of users of this platform. The reason for the high level of dependence stems from Russian energy exports which are denominated in US dollars. For this, the European Commission was reluctant to ban #Russia from SWIFT due to the dramatic impact it would have – on oil prices. Some fear this will create systemic global financial risk. For Russia, given its geographical location and the diversity of its international partners and the support it currently receives from China for its international transactions, the impact expected and even qualified as “Nuclear Financial Bomb” by Bruno Le Maire, the Minister of the Economy, will not have the effects desired or expected by the rest of the Western European Leaders.

In fact, Russia has not been completely banned from SWIFT entirely – the targets of the bans are selected aiming specific banks, which appears to be intended to make it more difficult to avoid previous sanctions imposed on these banks. Energy exports are apparently excluded from these sanctions, although there is a risk at the level of each transaction of the energy exports that ca be more difficult to negotiate and settle, which can always cause the rate of inflation to implode, especially for energy, metal and grain prices.

Better to find other financial instruments to support the Growth and the Productivity of European Firms especially the Women, Mid Sized and Small companies that they still have to compete at the level of the international market with the oligopolies and the conglomerates that do not respect any national border, just remember what has predicted JJSS in his famous plaidoyer for the construction of Europe with allegiance to these giants transnational challenges.

Ms. Christine Lagarde with the financial policies you have been advocating in regards to the inflation and the position you took, that is “Wait and See” is an evidence that you have not completely turned the page of the IMF and the World Bank influences in designing strategies of recovery and stimulation of growth that they included in their conditionalities toward developing countries and now you are applying for European countries.

Said El Mansour Cherkaoui – Update 3/5/2022

Feb 27, 2022 – A decision by Western allies on Saturday to block “selected” Russian banks from the SWIFT payments system will inflict a crippling economic blow, but also cause much pain to their own companies and banks and the allies still have room to do more.

Society for Worldwide Interbank Financial Telecommunication, known by the acronym SWIFT is a western interbank network. Based in Belgium, SWIFT was founded in the 1970s, is a co-operative of thousands of member institutions which use the service. SWIFT works 24/7 and allows 10mb to be transmitted across its network that links more than 11,000 banks operating in at least 200 countries and territories around the world. SWIFT has become the principal mechanism for financing international trade. In 2020, around 38 million SWIFT ‘FIN messages’ were sent each day over the SWIFT platform, according to its 2020 Annual Review. Each year, trillions of dollars are transferred using the system. SWIFT made a profit of €36 million in 2020 an it runs principally as a service to its members.

🌎 Russia and China Financial Response

The Russian financial messaging system SPFS is already linked to the Chinese cross-border interbank payment system CIPS.

The Chinese government has not dubbed the Russian military actions an “invasion” so far. Chinese foreign ministry spokesperson Wang Wenbin retorted:” the countries that have seen their reputation tarnished are the ones who intervene in other countries’ affairs and provoke wars in the name of human rights and democracy.”

🌎 BRICS and the Building of Financial Great Wall

★ Said El Mansour Cherkaoui, Ph.D. ★ Published on July 1, 2015 – 78 articles published at LinkedIn Great Wall and Great Break Banking Time for BRICS From July 2014 to July 2015, the BRICS group, the new emerging economies of Brazil, Russia, India, China and South Africa signed a Memorandum of Understanding to create Continue reading –

Russia’s US$140 billion of Chinese bond holdings are ‘major foreign assets’, could be used to skirt sanctions

Bank of Russia could hold US$80 billion of yuan debt, while the National Wealth Fund is estimated to own US$60 billion, according to Australia & New Zealand Banking Group

The total represents almost a quarter of foreign ownership in China’s domestic bond market, according to their estimates

Russia’s central bank and sovereign wealth fund probably own a combined US$140 billion worth of Chinese bonds, assets that they may seek to access given global sanctions, according to estimates by Australia & New Zealand Banking Group.

BEIJING, March 1. China and Russia will continue normal mutually beneficial trade cooperation, China’s Foreign Ministry Spokesperson Wang Wenbin told a briefing on Tuesday when asked whether sanctions slapped on Russia would trigger the growth of Russia’s demand for Chinese imports, as well as increase the role of yuan in bilateral trade.

Speaking at a regular daily news briefing, Wang Wenbin brushed off a call from the White House on Sunday for China to condemn Russia’s invasion of Ukraine, saying that China always stands on the side of peace and justice and decides its position on the merits.

China has refused to condemn Russia’s attack on Ukraine or call it an invasion, and has repeatedly called for negotiations while acknowledging what it describes as Russia’s legitimate security concerns.

Western countries have been ratcheting up sanctions that are intensifying pressure on Russian President Vladimir Putin.

“We are against using sanctions to resolve problems, even more so against unilateral sanctions without international mandate. China and Russia will continue regular trade cooperation based on the spirit of mutual respect and equality, equality and mutual benefit,” Wang said.

“We have repeatedly revealed our position. We believe that sanctions have never been an efficient way of solving issues,” the diplomat said, adding that “the Chinese side has always opposed any illegal unilateral sanctions.”

🌎 RUSSIA – CHINA TRADE

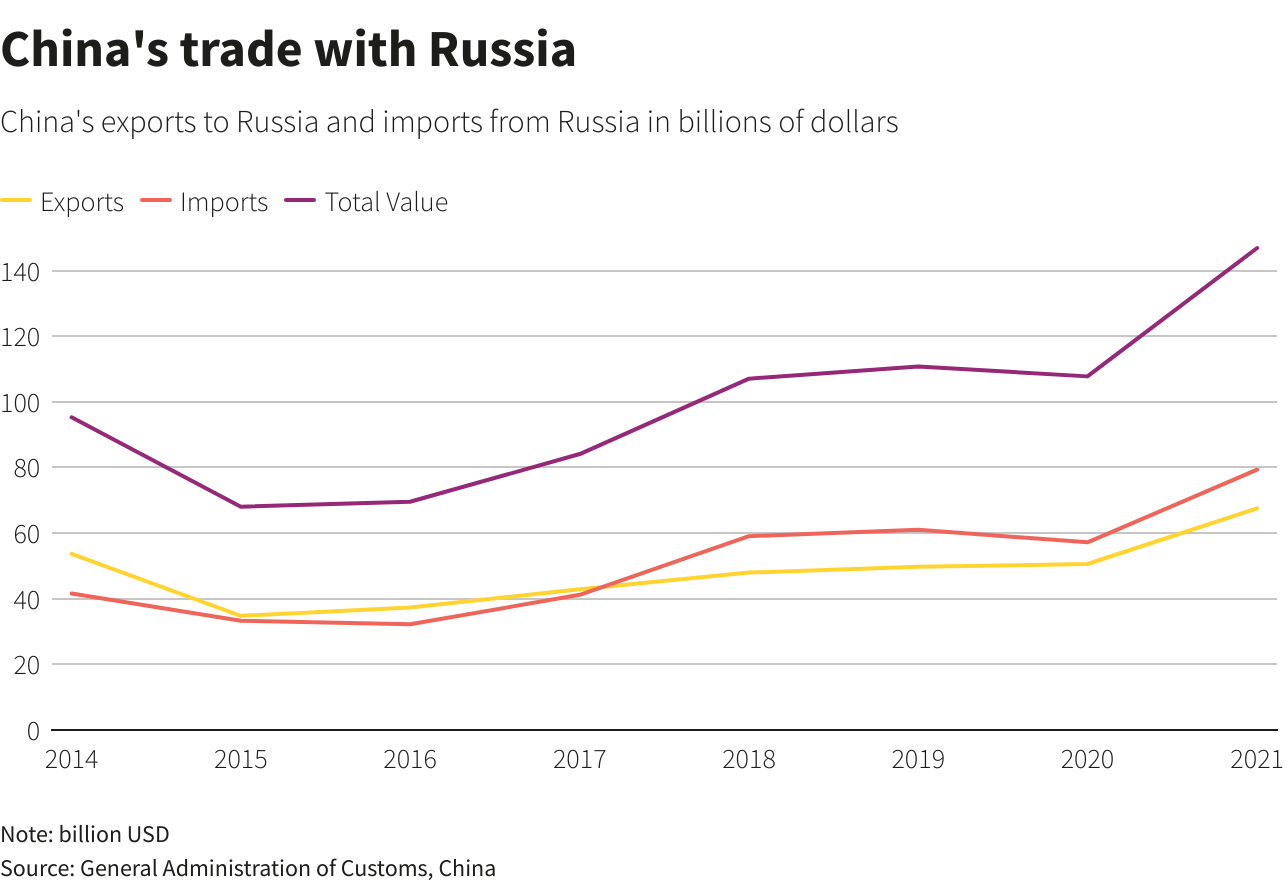

Since sanctions were imposed in 2014 after Russia annexed Crimea, bilateral trade has expanded by more than 50% and China has become Russia’s biggest export destination.

China-Russia trade hit US$110 billion in 2020, with both sides aiming to double this by 2024. While much of this trade has been in energy and other commodities, the non-energy portion of bilateral trade has been growing into other sectors and currently consists of 30% of the bilateral flows.

Keeping that momentum going and bringing new business sectors into the mix would boost both Chinese and Russian economies, badly affected both by the actions of the United States (trade war, sanctions) and Covid-19 and actually the Russia – Ukraine conflict.

Total trade between China and Russia jumped 35.9% 2021 to a record $146.9 billion, according to Chinese customs data, with Russia serving as a major source of oil, gas, coal and agriculture commodities, running a trade surplus with China.

“China and Russia will continue normal trade cooperation for mutual respect, equality and mutual benefit,” he noted. China-Russia trade is expected to amount to $200 Billion in 2022. RMB settlement accounts for more than 17% of China-Russia bilateral trade settlements and more than 12% of Russia’s international reserves.

The two were aiming to boost total trade to $200 billion by 2024, but according to a new target unveiled last month during Russian President Vladimir Putin’s visit to Beijing for the Winter Olympics, the two sides want bilateral trade to grow to $250 billion.

Leave a comment